|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

When Can You Refinance a Home: A Comprehensive GuideRefinancing a home can be an excellent financial strategy, but the timing is crucial. Understanding when to refinance can save you money and lower your monthly payments. This guide will explore the best times to refinance and the factors you should consider. Understanding Home RefinancingHome refinancing involves replacing your current mortgage with a new one, ideally with better terms. It can be a powerful tool to manage your finances effectively. Why Refinance?

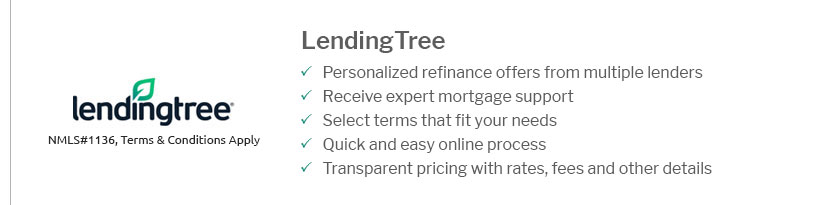

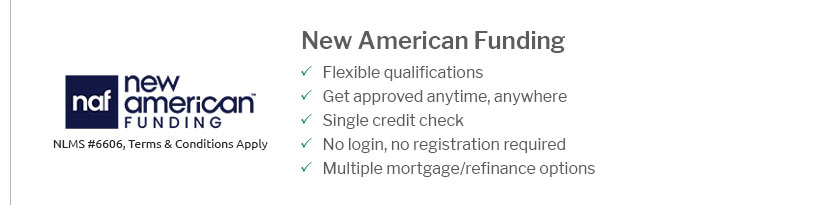

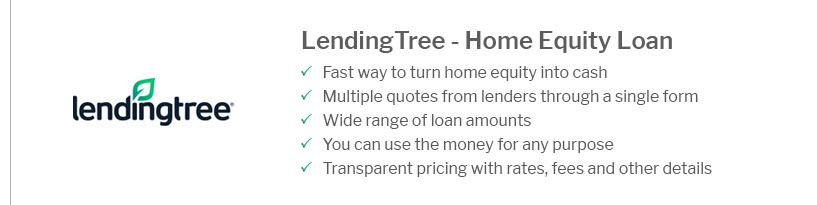

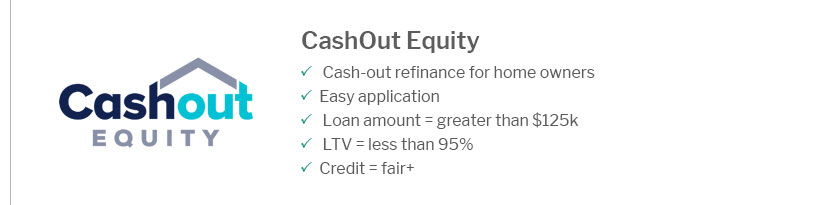

Ideal Times to RefinanceRefinancing isn't always beneficial, so knowing the optimal times is key. When Interest Rates DropIf current interest rates are at least 1% lower than your existing rate, it might be a good time to refinance. Improved Credit ScoreA higher credit score can help you qualify for better loan terms and lower interest rates. Things to Consider Before RefinancingSeveral factors can influence the decision to refinance, and weighing these considerations can help ensure a smart choice. Closing CostsRefinancing comes with closing costs that can range from 2% to 5% of the loan amount. Calculate whether the long-term savings outweigh these costs. Loan TermConsider whether you want to extend your loan term or reduce it. Extending can lower monthly payments but increase the total interest paid over time. For more information on refinancing, you can explore a list of top 10 home refinance companies to find the best options. How to Start the Refinancing ProcessOnce you've decided to refinance, follow these steps to ensure a smooth process. Gather Financial DocumentsOrganize your income statements, tax returns, and other relevant financial documents before starting the application process. Shop AroundIt's essential to compare offers from different lenders. Check out top home refinance lenders for the best rates and terms. Frequently Asked QuestionsHow often can I refinance my home?Technically, you can refinance as often as you like. However, consider the costs and whether the benefits outweigh these expenses. Is it worth refinancing for a 1% rate reduction?A 1% reduction can be significant over time, but it's essential to calculate the breakeven point to ensure savings exceed refinancing costs. What are the risks of refinancing?Risks include extending your loan term, increasing total interest paid, and the potential for foreclosure if you're unable to meet the new terms. https://www.freedommortgage.com/learning-center/articles/how-often-refinance-home

There is usually no limit on how often you can refinance and no right or wrong number of times to refinancejust the number of times refinancing makes financial ... https://www.reddit.com/r/FirstTimeHomeBuyer/comments/1d8d1mo/how_long_do_you_have_to_wait_to_refinance/

You can refinance as soon as it makes sense financially for you to do so. Though the original lender and loan officer would really, really, and I mean really, ... https://finance.yahoo.com/personal-finance/mortgages/article/how-soon-can-you-refinance-a-mortgage-160817800.html

It depends. In some cases, homeowners may be able to refinance immediately. But depending on your home loan type and lender's requirements, you may have to ...

|

|---|